Employee salary tax calculator

SalaryWage and Tax Calculator - calculate taxes gross wage and net wage. Annual Salary Tax Rate.

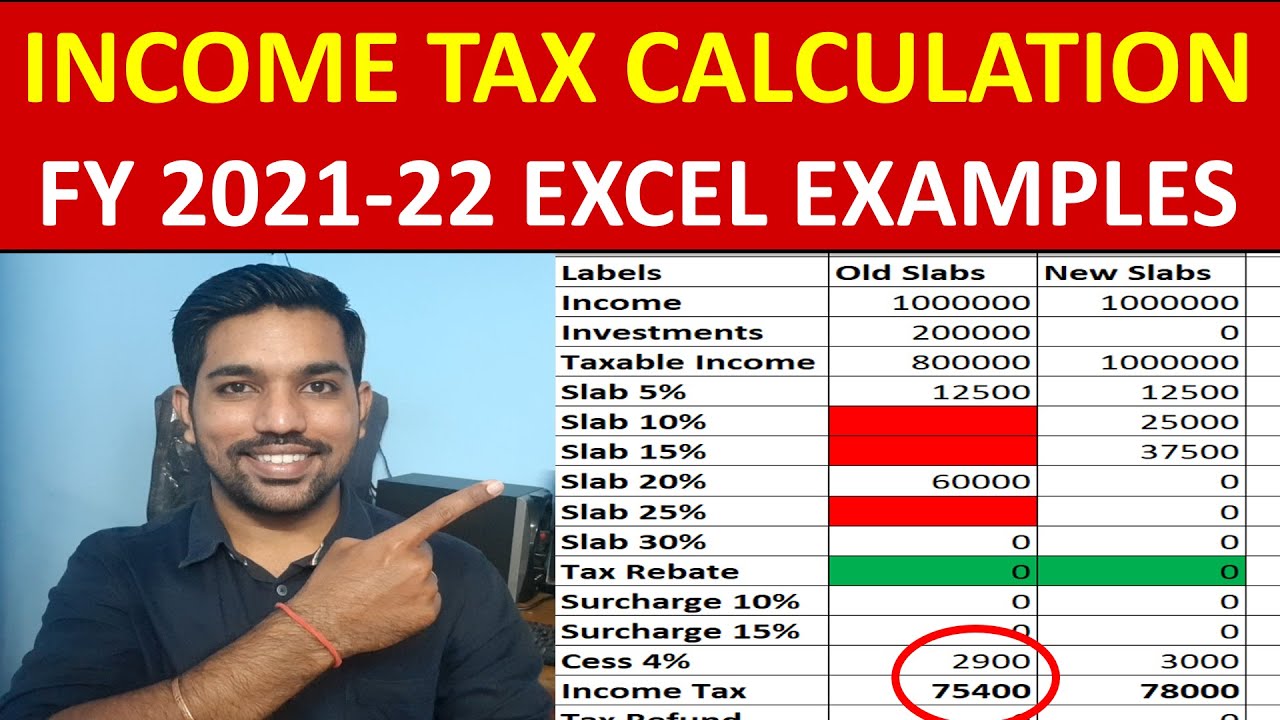

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

You can compare different salaries to see the difference too.

. Updated for tax year 2022-2023. About the Australian Tax Calculator. UK Tax Salary Calculator.

The interest and often the contributions are tax-deferred. Unemployment insurance employee 16 Funded pension II pillar Employee didnt apply for temporary rise of payments. Calculate monthly income and total payable tax amount on your salary.

SalaryWage and taxes in Estonia. Now the gross salary of the employee is CTC PF. As per the EPF Act 12 percent of an employees basic salary and dearness allowance has to be invested in EPF and the employer needs to invest an equal sum.

Before tax thats an annual salary of 61828. Gratuity paid by the employer is basic wage2615 Step 4. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below.

In Kenya the government manages the PAYE tax through the Kenya Revenue Authority KRA which collects the statutory contributions from the employer before salary and wages are paid to the employee. Using the Japan Tax Calculator you can get an idea of the amount of taxes you might have to pay. To make sure this cap is applied to your calculations tick the box.

The standard rate for the employee is 635 while the employer pays at least 2990 of an employees salary depending on the occupation. The results that the calculator give you are calculated with consideration to the most recent income tax and social security information available for the tax year 202223. 20222023 Federal and State Income Tax Salary Calculator.

Both the employer and the employee contribute 12 of the employees basic salary each month to the EPF or employee provident fund. Salary Tax Calculator for year 2022 - 2023. Salary increase chart 2018 19 budget salary notification 2018 salary slip format pakistan salary slip sample pakistan employee salary slip pakistan employee salary slip format in excel tax rate 2018 pakistan tax rates 2018-19.

Nonprofit organizations have similar plans known as 403bs or TIAA-CREF plans. Calculate PF contribution paid by employer ie 12 of the basic wage. And so if youre self-employed you dont have to pay FICA on all your salary just on 9235 of it 9235 being 100 minus 765 - which is the contribution that your.

How to calculate income tax in Australia in 2022. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Individual Income Tax IIT.

If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12. The contribution made by the employee towards the EPF is available for a deduction under Section 80C of the Income Tax Act 1961. SalaryWage and taxes in Latvia.

Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee. Employee contribution to the provident fund. The salary calculator for income tax deductions based on the latest Australian tax rates for 20222023.

Company employee First year in Japan Blue Return System Your net income is. This income tax applies to all employees permanent temporary full time and part time except for the employment that is not longer than 1 month. The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023.

Close Dont reduce pension contributions when on furlough. Benefits calculator help employee combine salary and benefits to calculate total compensation cost. After tax that works out to a yearly take-home salary of 49357 or a monthly take-home pay of 4113 according to our New Zealand salary calculator.

Our calculator has recently been updated to include both the latest Federal Tax. Income_net to_yens. Applied for rise of payments during 2014-2017.

When calculating salary costs for your employer pays. Social security contributions in Spain have a minimum and maximum cap determined by the employees level of studies. Calculate the basic wage from the CTC 40-50 of CTC Gross Salary Calculation.

The Australian Salary Calculator includes income tax deductions Medicare Deductions HEPS HELP calculations and age related tax allowances. Is a tax paid by both the employee and the employer. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that varies by income level reaching rates as high as 133 in California. What the previous paragraph shows is that being self-employed is like being an employee but at a lower salary - lower by the FICA half that employers pay for their employees. This number is quite a bit higher if we look at.

Use our salary calculator to check any salary after tax national insurance and other deductions. The government subsidy is limited to 80 of the employees salary or 2500 per month whichever is the lower. The contribution deducted from the employees account is exempted from tax up to Rs 15 lakh.

This deduction is provided under section 80C of the Income-tax Act1961. Pro-Rata Furlough Tax Calculator. Covering more than 90 cities in China Direct HRs Salary Calculator provides total employer cost gross or net salary for any given value.

Take Home Salary Calculation from CTC Step by Step Process. Select the columns you would like to display on the wage summary table. New York Salary Tax Calculator for the Tax Year 202223 You are able to use our New York State Tax Calculator to calculate your total tax costs in the tax year 202223.

Paycheck Calculator Take Home Pay Calculator

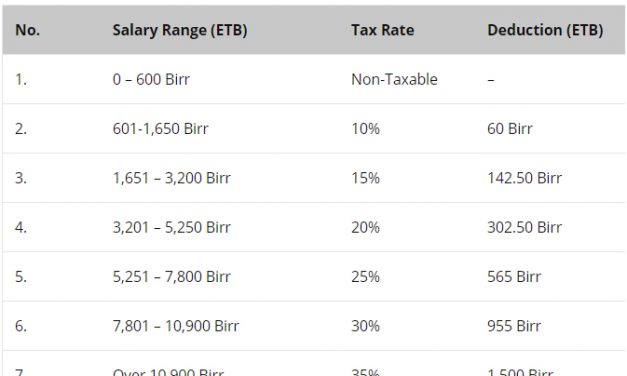

Sep 2022 Salary Income Tax Calculation In Ethiopia Latest Ethiopian News Addisbiz Com

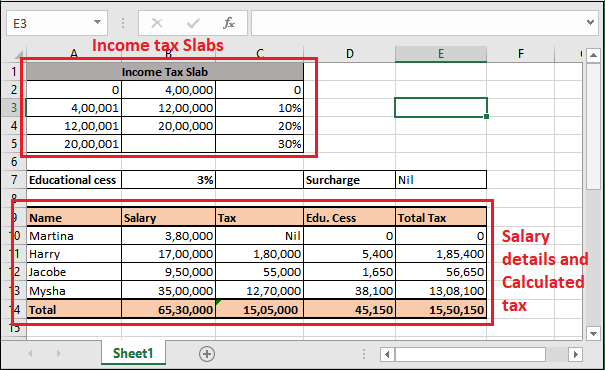

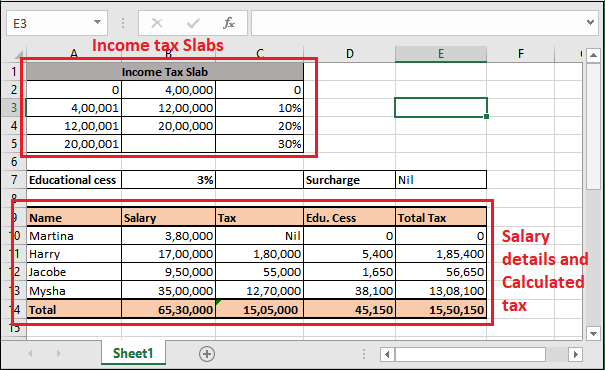

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

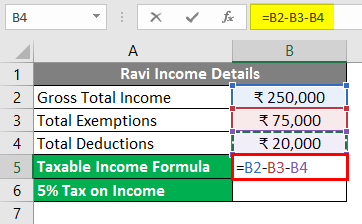

Excel Formula Income Tax Bracket Calculation Exceljet

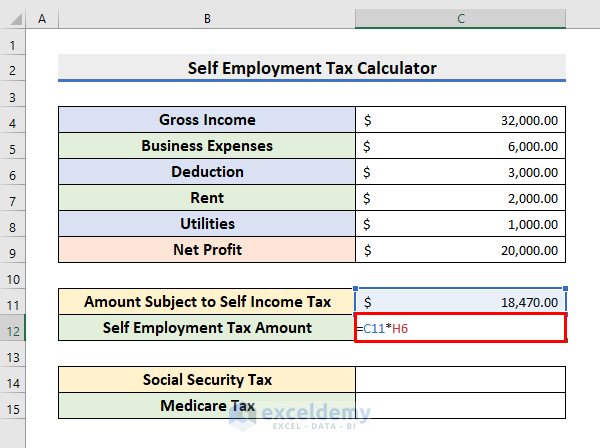

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

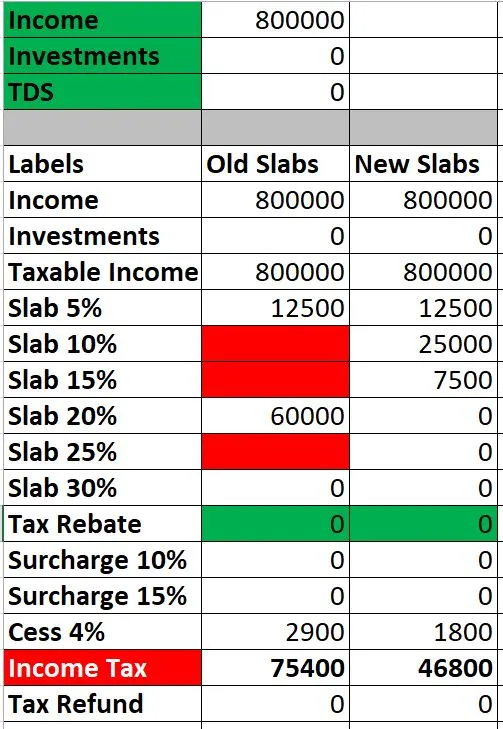

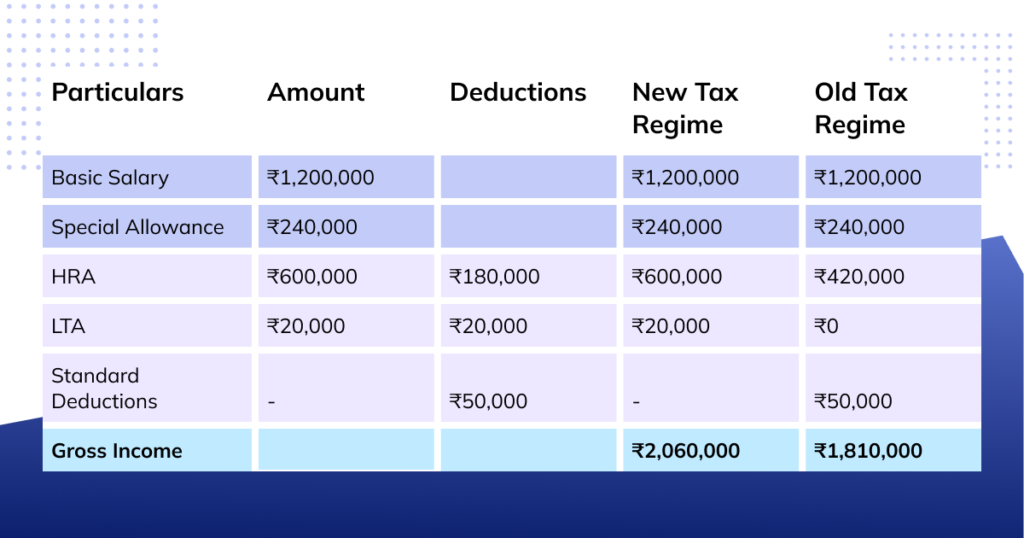

How To Calculate Income Tax On Salary With Example

Ethiopian Income Tax Calculator 10 0 3 Free Download

How To Calculate Income Tax In Excel

Paycheck Calculator Take Home Pay Calculator

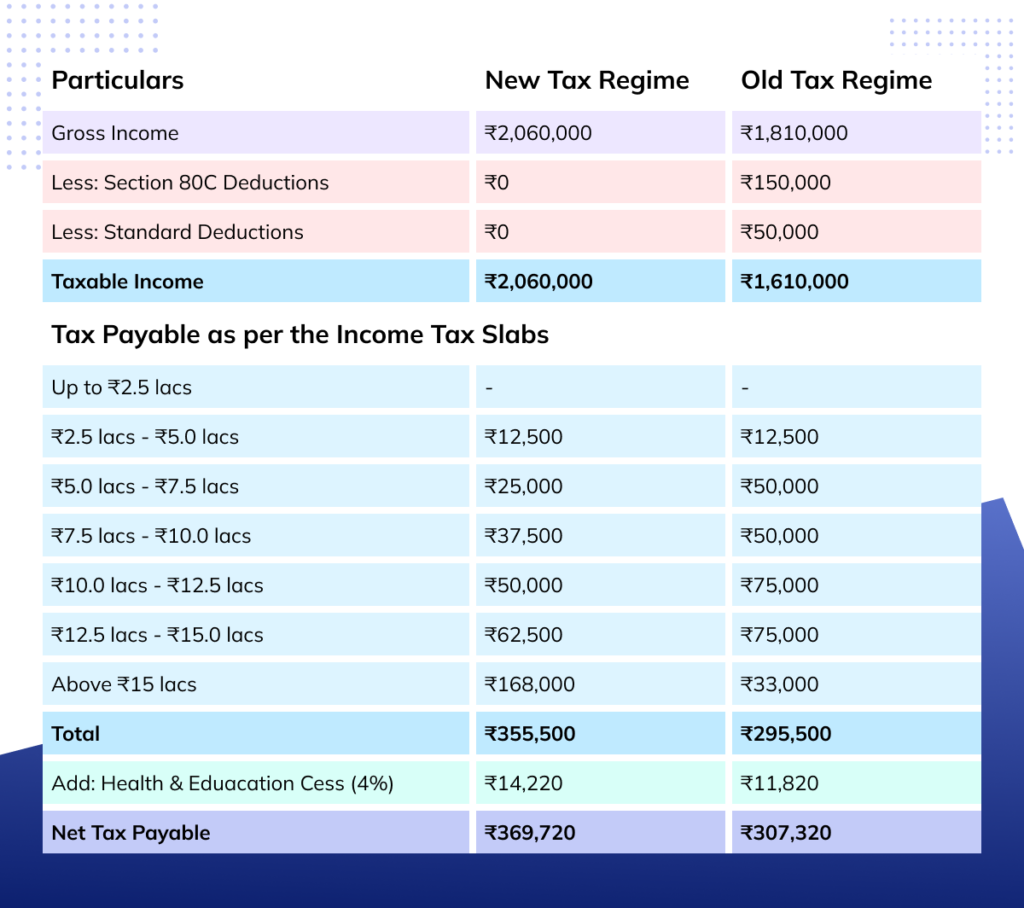

Income Tax Calculator Calculate Taxes For Fy 2022 23 2021 22

Income Tax Formula Excel University

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

How To Calculate Net Pay Step By Step Example